1. Tax Planning

Minimize capital gains: Use QSBS, installment sales, or charitable trusts where applicable.

Estimated tax payments: Plan for IRS deadlines post-liquidity.

State residency planning: Consider relocating before an exit to reduce state tax burden.

2. Asset Protection

Shield wealth from lawsuits or creditors: Use LLCs, irrevocable trusts, and umbrella insurance.

Prenuptial/Postnuptial agreements: Especially important if exiting while married or planning to remarry.

3. Investment Diversification

Rebalance out of concentrated stock positions: Many founders exit with large exposure to one company.

Core allocations: Anchor portfolio in low-cost index funds (like the S&P 500), complemented by private credit, real estate, or venture.

4. Liquidity Management

Plan cash flow needs: Budget for lifestyle changes, taxes, and large one-time purchases.

Establish cash reserves: Even after a big exit, founders can experience income gaps during their next venture or transition.

5. Estate Planning

Update or create a will and trust: Ensure your wealth passes according to your wishes.

Use lifetime gifting strategies: Leverage annual exclusion gifts or set up GRATs and SLATs.

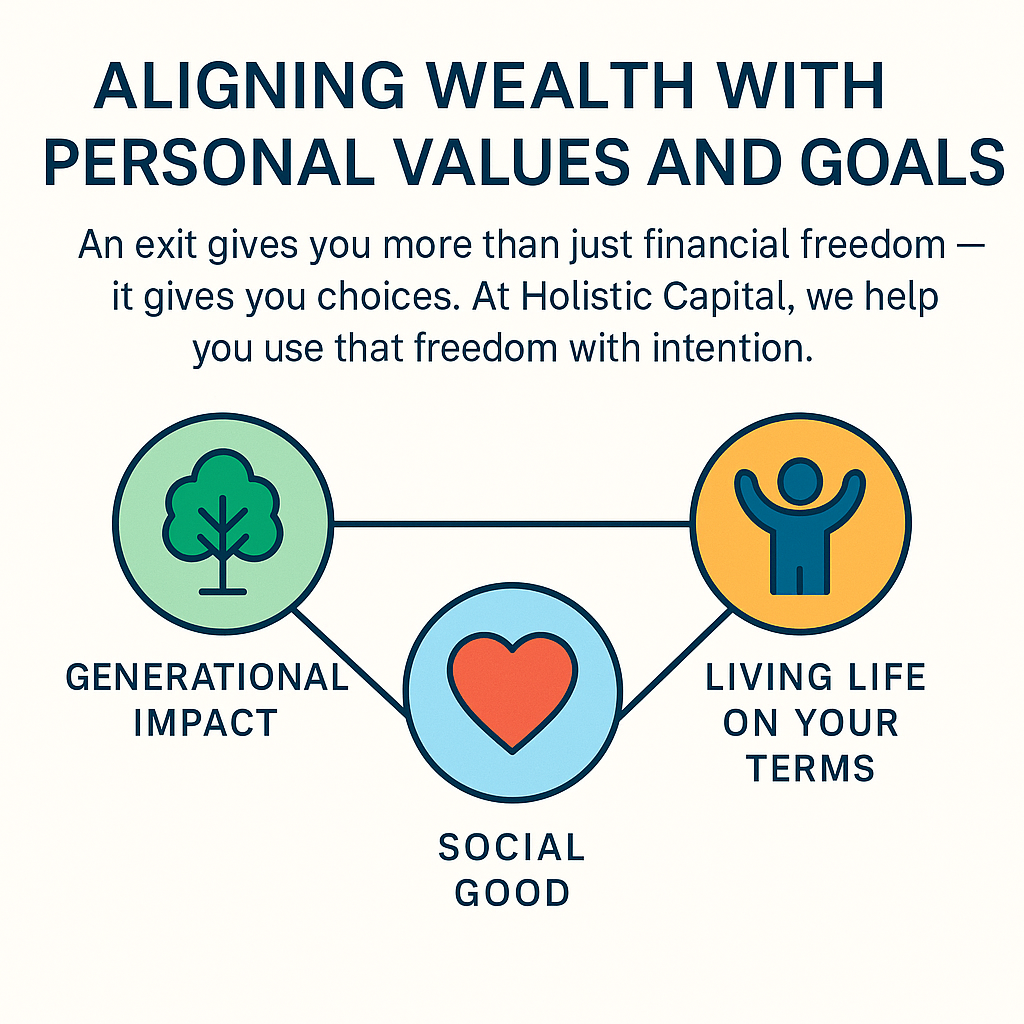

Philanthropic goals: Donor-advised funds, private foundations, or impact investing.

6. Identity & Purpose

-

What’s next? Many founders face identity loss after an exit. Helping them find meaning through advising, investing, or starting again is key.

-

Avoid lifestyle inflation: Provide behavioral guidance and mindset coaching if needed.